BalanceAI Token

Overview

The native token of BalanceAI Network is BalanceAI Token, with the ticker BAI.

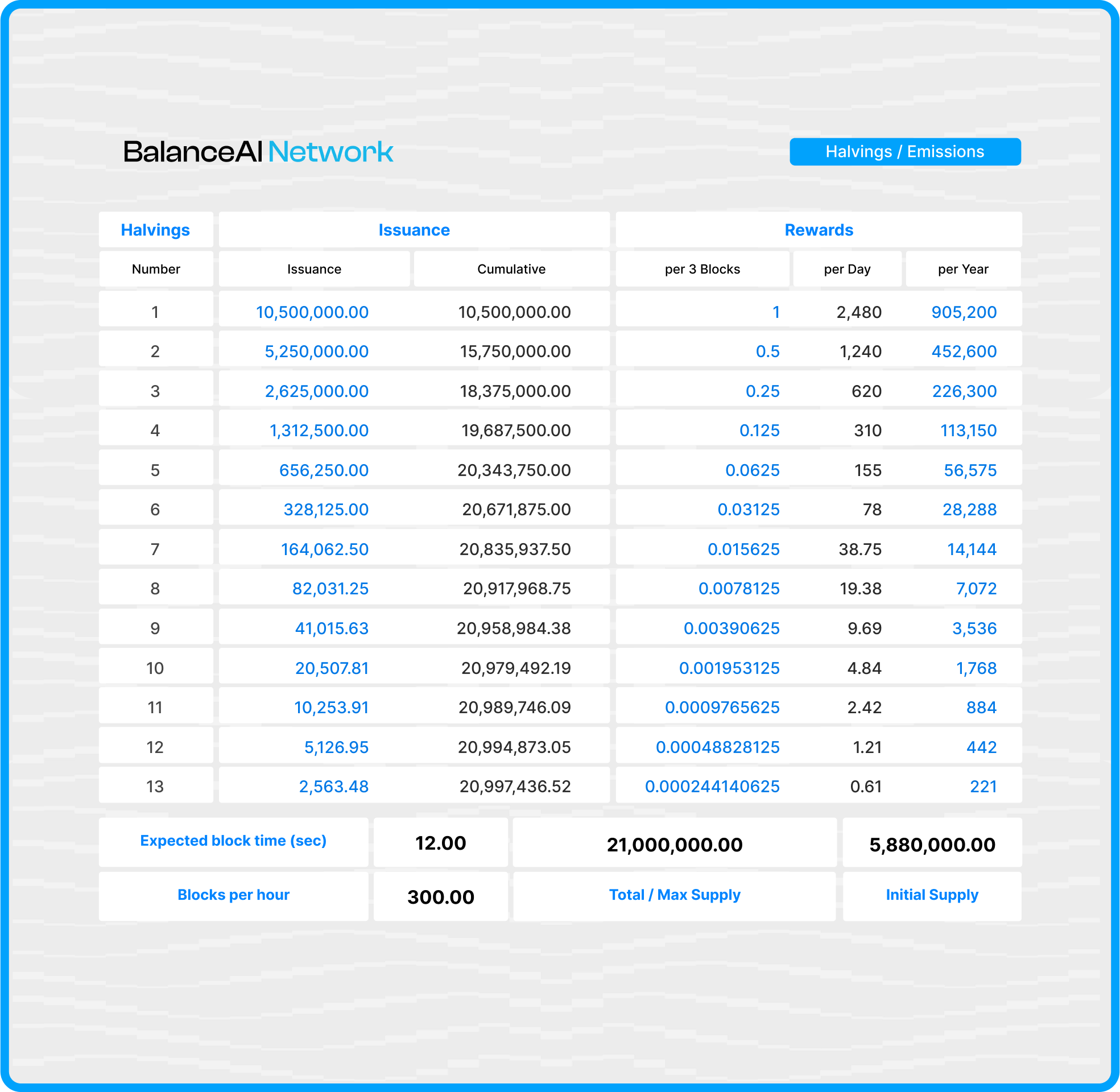

The supply of $BAI is 21,000,000 and there is a halving cycle such that for every 10.5 million blocks, rewards per block halve. Currently, every 36 seconds (three blocksteps), 1 single BAI emits into the network. There will be 64 halving events, with the first occurring in 2028.

BAI token has 9 decimals.

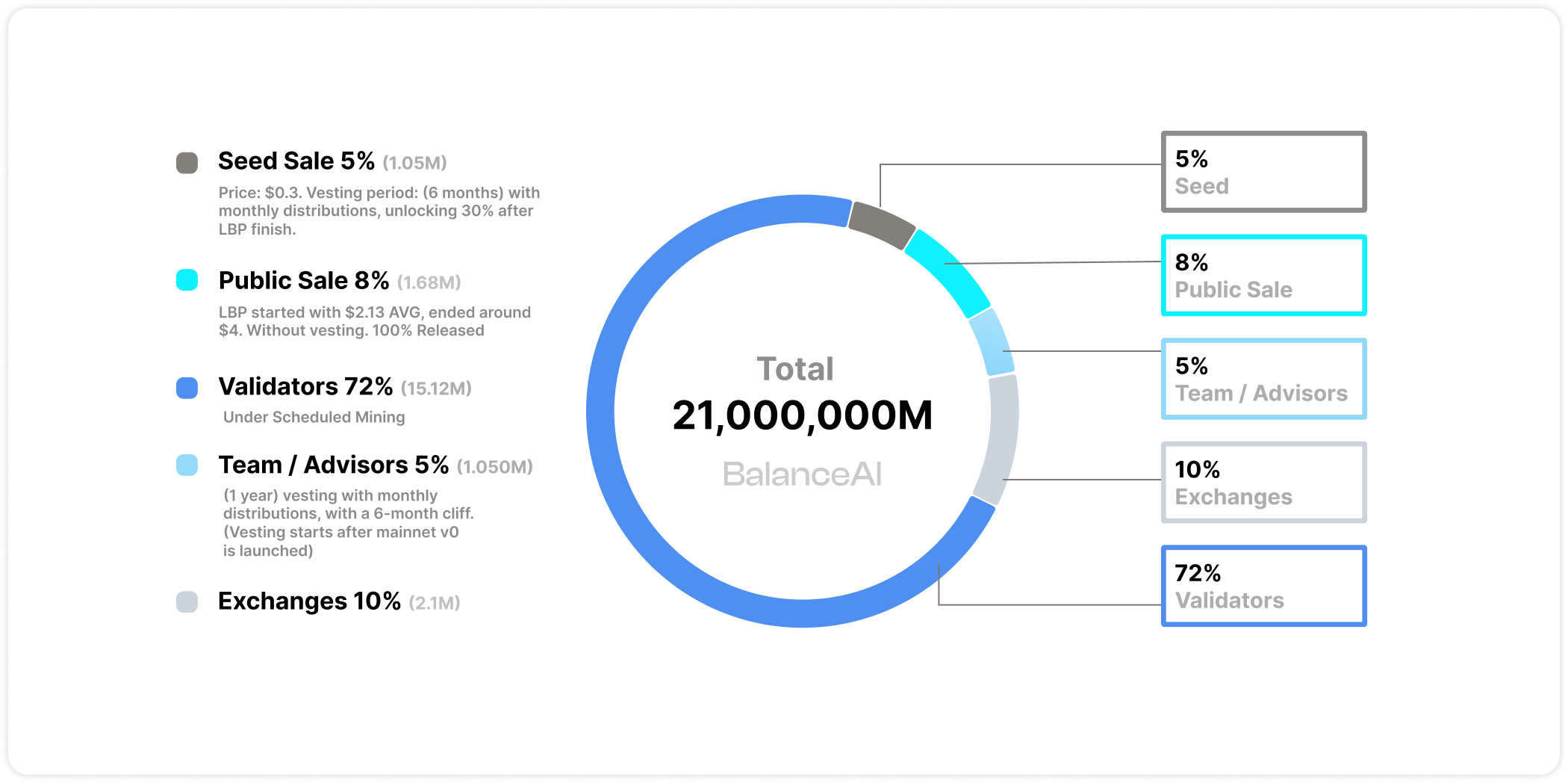

At the genesis, BAI are allocated as follows:

As there is a limited amount of BAI (≈ 21 million) the BAI reward must decrease over time to prevent all tokens from being distributed too soon. This is the only way new tokens can be added to the network. The equation below shows the formula for the total number of tokens mined per halving with 𝑖 = the reward era. Summing from the 0th period to the 32nd period, we get our total number of BAI tokens » 21 million.

Utility

BalanceAI Token is the utility token for BalanceAI Network that has 4 primary functions.

- Staking

- Incentivising models and agents providers

- Transactions

- On-chain Governance (in the future)

Staking

BalanceAI the native token plays a central role in securing the network and incentivizing participants. Here's how native tokens are used in staking and how they receive rewards:

-

Staking Requirement: Validators in a staking system are required to hold a certain amount of the native token and lock it up as collateral to participate in the staking process. This is often referred to as "staking" or "bonding" the tokens. The amount of tokens required to stake varies depending on the specific protocol and network.

-

Block Validation: Validators are responsible for validating transactions and creating new blocks in the blockchain. Validators are chosen based on a variety of factors, including the amount of tokens they have staked. Holding a larger stake typically increases the chances of being selected as a validator.

-

Rewards Distribution: Validators who successfully validate transactions and create new blocks are rewarded with additional tokens as an incentive for their participation and contribution to the network. These rewards are typically distributed from a pool of tokens set aside for staking rewards.

-

Distribution Mechanisms: The distribution of staking rewards varies depending on the consensus mechanism and network protocol. In some systems, such as Proof of Stake (PoS), validators receive a portion of the transaction fees collected in the blocks they validate, as well as newly minted tokens. In other systems, rewards may be distributed differently, such as through inflationary mechanisms or network fees.

-

Duration of Staking: Validators are usually required to stake their tokens for a certain period of time to participate in the staking process. This helps promote network stability and security by encouraging long-term commitment and discouraging validators from engaging in malicious behavior. The current unbounding period for BalanceAI chain is 21 days.

-

Slashing: Validators may face penalties, such as slashing, for failing to follow the rules of the network or engaging in malicious behavior. Slashing typically involves the confiscation of a portion of the validator's staked tokens as a penalty for their actions.

Overall, staking provides a mechanism for securing blockchain networks and maintaining their integrity, while also offering incentives for participants to actively contribute to the network's operation and growth.

Incentivising models and agents providers

Part of the block rewards are accumulated in the Models/Agent Creators Fund. The Fund is used to reward participants (models and/or agent creators/providers) with continuos grants.

Emissions

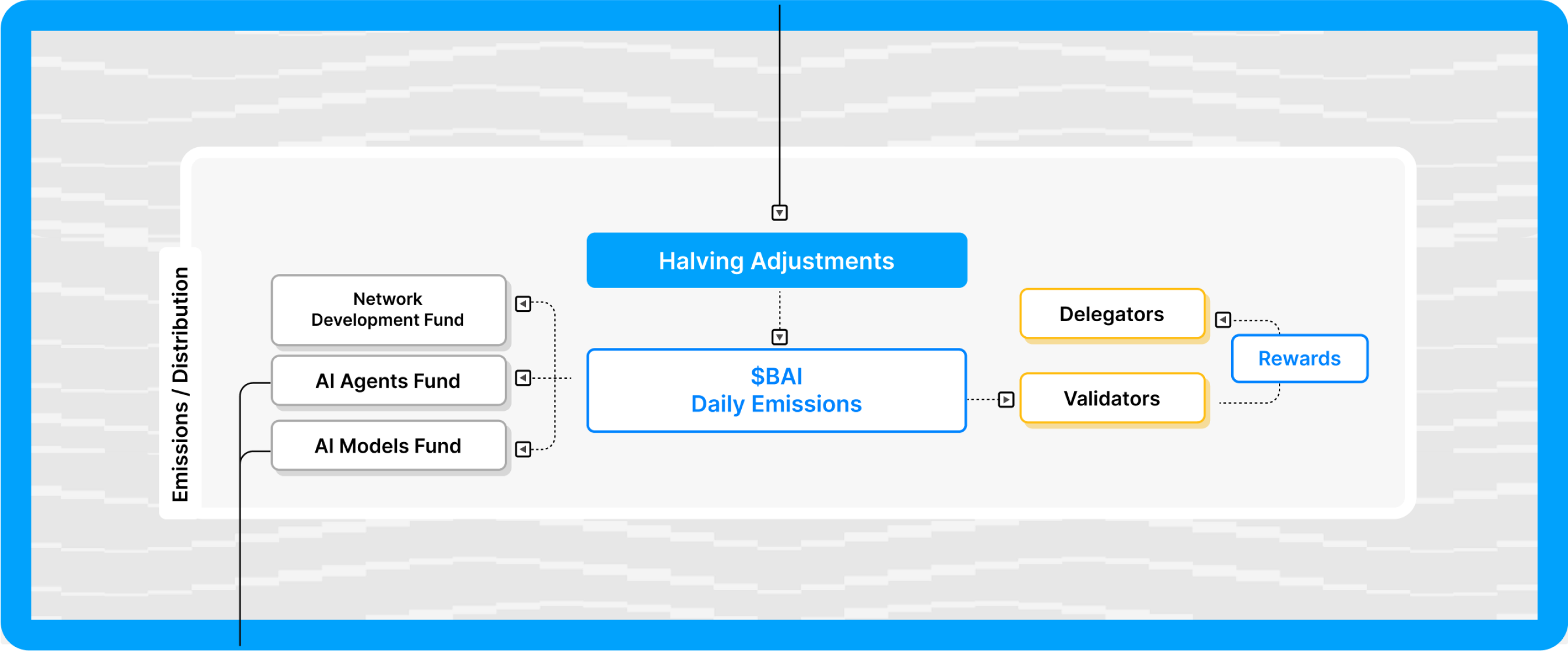

Emissions can be categorized as follows:

- Delegators/Validators 44%

- Mining (AI Models/Agents Funds) 48%

- Network Development Fund 8%

Transactions

Every on-chain transaction requires the sender to pay fees. Part of the fee is burned and part is deposited to the validators set.

Locks and Vesting

Seed and Team tokens are being locked and vested automatically using Smart Contracts and Vesting accounts.

On-chain Governance

At BalanceAI Network, we believe in the power of decentralized decision-making. That's why we're committed to implementing on-chain governance, where every member of the community has a say in shaping the network's future. The BalanceAI token plays a crucial role in this process, serving as the primary means for facilitating governance activities such as voting and referenda. (Work in Progress)

Wrapped

wBAI is our wrapped token in Ethereum Network, it's pegged 1:1 ratio with BAI native token.

https://etherscan.io/address/0x8CCD897ca6160ED76755383B201C1948394328c7